kupibest24.ru News

News

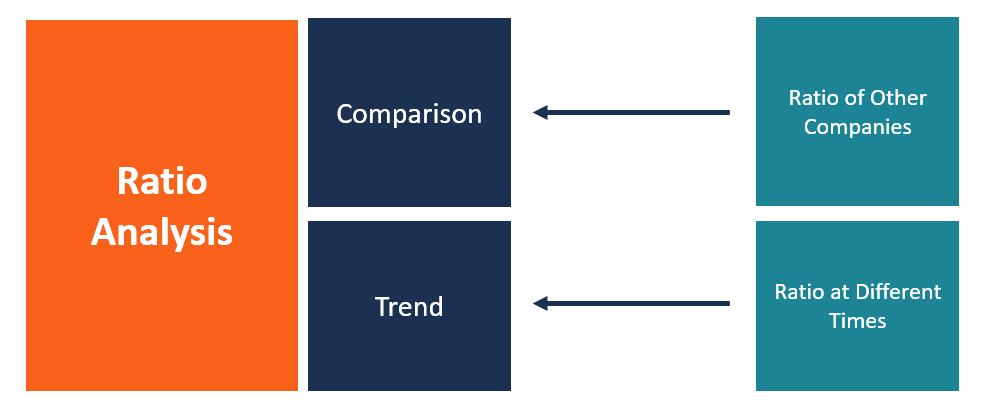

What Is Ratio Analysis

Ratio analysis can provide insight into companies' relative financial health and future prospects. It can yield data about profitability, liquidity, earnings. Ratio Analysis Formula: Current Ratio = Current Assets / Current Liabilities; Quick Ratio = (Cash & Cash Equivalents + Accounts Receivables. Ratio analysis is an accounting method that uses financial statements, like balance sheets and income statements, to gain insights into a company's financial. Quick Reference. The use of accounting ratios to evaluate a company's operating performance and financial stability. Such ratios as return on capital employed. Ratio analysis can be used to examine trends in performance, establish benchmarks for success, set budget expectations, and compare industry competitors. Financial ratio analysis is gaining valuable insights from your company's financial statements. By breaking down daunting figures into. Ratio analysis is primarily used to compare a company's financial figures over a period of time, a method sometimes called trend analysis. Through trend. A financial ratio or accounting ratio states the relative magnitude of two selected numerical values taken from an enterprise's financial statements. Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company. Ratio analysis can provide insight into companies' relative financial health and future prospects. It can yield data about profitability, liquidity, earnings. Ratio Analysis Formula: Current Ratio = Current Assets / Current Liabilities; Quick Ratio = (Cash & Cash Equivalents + Accounts Receivables. Ratio analysis is an accounting method that uses financial statements, like balance sheets and income statements, to gain insights into a company's financial. Quick Reference. The use of accounting ratios to evaluate a company's operating performance and financial stability. Such ratios as return on capital employed. Ratio analysis can be used to examine trends in performance, establish benchmarks for success, set budget expectations, and compare industry competitors. Financial ratio analysis is gaining valuable insights from your company's financial statements. By breaking down daunting figures into. Ratio analysis is primarily used to compare a company's financial figures over a period of time, a method sometimes called trend analysis. Through trend. A financial ratio or accounting ratio states the relative magnitude of two selected numerical values taken from an enterprise's financial statements. Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company.

Financial analysis is the process of examining financial statements and other relevant data to assess the financial health and performance of an organization. Activity ratios, also called efficiency ratios are used to measure a company's ability to convert their production into cash or income. Often measure over a. Dive into Ratio Analysis: Understand its goals, benefits, and how it aids in assessing financial health and making informed business decisions. KEY POINTS · Financial analysts use financial ratios to compare the strengths and weaknesses in various companies. · Financial ratios quantify many aspects of a. Ratio analysis is a quantitative investment technique used to compare a company on a relative basis to the market in general. Changes in ratios can help. Financial analysis is the systematic process of examining a company's financial statements, budgets, and projects to assess its performance and viability. Financial ratios notate the relationship between different items in the financial statement. See the application of liquidity, debt, and efficiency ratios in. Ratios are benchmarks calculated by relating two or more pieces of financial data about the business. That data is usually taken from the income statement and/. Ratio analysis can be used to compare the year to year profitability, liquidity and efficiency of a business or similar businesses. Current (or Working Capital) Ratio. Working capital is the excess of current assets over current liabilities. The ratio that relates current assets to current. Financial ratio analysis is the technique of comparing the relationship (or ratio) between two or more items of financial data from a company's financial. Ratio analysis is an approach to evaluating financial statements relying on the use of ratios to gain an understanding of a business' operating efficiency. Ratio analysis is a useful management tool that will improve your understanding of financial results and trends over time, and provide key indicators of. Financial ratios are a valuable tool for analyzing an organization's financial condition. While the point ratios and their extensions continue to provide. Financial ratio analysis is gaining valuable insights from your company's financial statements. By breaking down daunting figures into understandable ratios. Financial ratio analysis is a method used by businesses, investors, and analysts to evaluate and interpret financial statements. Meaning and definition of Ratio Analysis Ratio analysis is a tool brought into play by individuals to carry out an evaluative analysis of information in the. Ratio analysis refers to the analysis of the financial statements in conjunction with the interpretations of financial results of a particular period of. Ratio analysis is known as the study of ratio for checking the financial status of the company. It is performed by external analysts. Learn more here. What are Financial Ratios? Financial ratios help you interpret any company's finances' raw data to get actionable inputs on its overall performance. You can.

Youtube Tv Add To Library

:max_bytes(150000):strip_icc()/youtube-tv-library-eae77c41d4ab4c1395f73f822573294c.jpg)

Download the app or visit the website and sign in. · Use the search or guide to find your show. · Click the plus (+) icon to add it to your library, offering. Choose Hulu + Live TV and get more than regular Cable TV or YouTube TV. STARZ logo. Add STARZ - with a deep library of visionary original series, hit. In the YouTube TV mobile app, press down on your screen on any page to open a Menu. The Menu includes various actions, like adding a program to your library. Product features · Cable-free live TV. · Stream 85+ top broadcast and cable networks, including ABC, CBS, FOX, NBC, ESPN, HGTV, and premium add-ons. · Watch every. The Youtube TV name and logo are property of Alphabet Inc. AMC+ (ad-free): Our AMC+ (ad-free) add-on includes ad-free access to the entire AMC+ library for $4. CuriosityStream is available on YouTube TV as an add-on premium channel for $3 per month. YouTube TV members have access to cable-free live TV from over Stream live TV from ABC, CBS, FOX, NBC, ESPN & popular cable networks in English and Spanish. Record without DVR storage space limits. Try it free. library. Even though it is cool to be able to keep a recording for nine months before it drops out it is also necessary to add a delete button to delete. Everyone gets their own login and personal Library. Watch content on your tablet, phone, laptop or other compatible devices. 3 simultaneous. Download the app or visit the website and sign in. · Use the search or guide to find your show. · Click the plus (+) icon to add it to your library, offering. Choose Hulu + Live TV and get more than regular Cable TV or YouTube TV. STARZ logo. Add STARZ - with a deep library of visionary original series, hit. In the YouTube TV mobile app, press down on your screen on any page to open a Menu. The Menu includes various actions, like adding a program to your library. Product features · Cable-free live TV. · Stream 85+ top broadcast and cable networks, including ABC, CBS, FOX, NBC, ESPN, HGTV, and premium add-ons. · Watch every. The Youtube TV name and logo are property of Alphabet Inc. AMC+ (ad-free): Our AMC+ (ad-free) add-on includes ad-free access to the entire AMC+ library for $4. CuriosityStream is available on YouTube TV as an add-on premium channel for $3 per month. YouTube TV members have access to cable-free live TV from over Stream live TV from ABC, CBS, FOX, NBC, ESPN & popular cable networks in English and Spanish. Record without DVR storage space limits. Try it free. library. Even though it is cool to be able to keep a recording for nine months before it drops out it is also necessary to add a delete button to delete. Everyone gets their own login and personal Library. Watch content on your tablet, phone, laptop or other compatible devices. 3 simultaneous.

DVR: You can record a program by adding it to your library. This means that all airings—including upcoming airings and reruns—will be recorded automatically. Android TV · Open the Google Play Store app from the home screen · Go to the search bar and enter YouTube TV · Select the YouTube TV app, then select Install to. In addition, YouTube TV also announced a deal to add NBA TV and MLB Network. library access to Max's ad-free tier, and live feeds of the service's. Make your Library a bigger #NBAFinals fan than you are. Add the whole series to your Library in one go. #YouTubeTVTips. Today, I noticed that while trying to access my YouTube TV's library via my TV's Chromecast for Google TV, my library only shows my watchlist, and. Get the official YouTube app on Android phones and tablets. See what the world is watching -- from the hottest music videos to what's popular in gaming. Once again, the process is simple. Just click the “plus” icon to add programs to your library. Setting up DVR recordings while watching live TV. 1 Add shows and movies to your library · 2 Add your favorite teams and leagues to your library · 3 Pause your subscription · 4 Hide game scores · 5 Reorganize your. The YouTube TV application mainly has three pages- library, home, and live. You have to choose the library. This has all the different recordings that YouTube. Add Video to Library · Run the YouTube TV app on your mobile device. Otherwise, you visit the official website via your favorite browser on your PC/Mac. · Sign in. YouTube TV is a streaming service that offers live TV channels, DVR cloud storage, and on-demand content, all without the need for a traditional. Choose an event from the live guide that is yet to be aired, and then click on “More Info,” followed by “Add to library.” You will be able to save only an. A new report from 9to5 Google indicates that YouTube TV is launching a revamped Library tab, which is making its way to subscribers on various devices this week. I am trying to replay today's Dutch Grand Prix Qualifying recording from my Library but all I get is the whirling circle and a blank screen. Can I add my. Step 1: Update the YouTube TV App · Step 2: Install the HBO Max App · Step 3: Access Your YouTube TV Account · Step 4: Navigate to Settings · Step 5: Subscription. Open YouTube TV and go to the “Library” tab. · Select the show, sports team, or event you want to record. · Next to the program's name, click on the plus icon (or. Part 1: How to Record on YouTube TV with DVR · Launch YouTube TV on your preferred device · Tap the + (Add) icon from the top-right corner of the thumbnail of the. Look for the “+” symbol next to the show's title, which indicates that it can be added to your library. Clicking on this symbol will add the show or movie to. Library. YouTube TV. @youtubetv. K subscribers•97 videos. YouTube TV is a TV streaming YouTube TV - NBA Finals Ad: Emily. M views. 3 years ago. They are saved in the YouTube TV cloud so as long as you have access to the internet and a current user account, you can access the recordings in the Library.

How Does Credit Card Debt Work

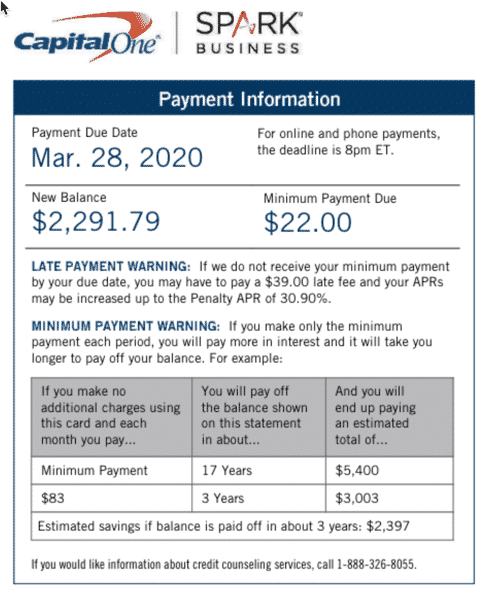

Each time you make a purchase using your credit card the amount is added to your account. The total amount you owe is called the balance. Interest free period. If you check your balance every week, then you can see when these charges hit. Add up all the charges that hit your card each week and send a payment. Even if. You pay interest on the money you borrow. For example i currently have a card at 3k that i used to pay part of my car loan with. The minimum. The total minimum payments of all your debt ($ + $) is $ That leaves you with $ remaining from your $ budget. Put that $ toward the cash-back. Credit card debt is a type of unsecured liability that is incurred through revolving credit card loans. It greatly affects your credit score. Credit card debt is the most common form of revolving debt. Handling credit card debt – just the facts. When it comes to things like credit cards or how to pay. Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set aside an amount to repay your credit. Credit card debt is money a company owes for purchases made by credit card. It appears under liabilities on the balance sheet. If you carry a balance on your credit card, the card company multiplies it each day by a daily interest rate and adds that to what you owe. The daily rate is. Each time you make a purchase using your credit card the amount is added to your account. The total amount you owe is called the balance. Interest free period. If you check your balance every week, then you can see when these charges hit. Add up all the charges that hit your card each week and send a payment. Even if. You pay interest on the money you borrow. For example i currently have a card at 3k that i used to pay part of my car loan with. The minimum. The total minimum payments of all your debt ($ + $) is $ That leaves you with $ remaining from your $ budget. Put that $ toward the cash-back. Credit card debt is a type of unsecured liability that is incurred through revolving credit card loans. It greatly affects your credit score. Credit card debt is the most common form of revolving debt. Handling credit card debt – just the facts. When it comes to things like credit cards or how to pay. Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set aside an amount to repay your credit. Credit card debt is money a company owes for purchases made by credit card. It appears under liabilities on the balance sheet. If you carry a balance on your credit card, the card company multiplies it each day by a daily interest rate and adds that to what you owe. The daily rate is.

A credit card can help you build credit, make convenient payments and meet everyday expenses in your life. Getting an understanding of how credit cards work. A debt consolidation loan may work similarly to a balance transfer card. Debt consolidation loans are personal loans you can use to pay off multiple debts and. Work on making it a habit to always pay off your credit card in full. When it's not possible, make sure you have a plan to get rid of the debt and prevent it. Transferring the debt via a balance transfer · Low or 0% interest credit cards are hard to get if you do not have a good credit rating · Look out for fees · Most. Credit card debt is revolving. This means the more debt you put in by making charges, the higher your bills are coming out the other side. So, the amount you. Credit card interest is usually compounded daily. This means that any interest you owe is added back to your existing balance and becomes part of the principal. With the debt avalanche method, you prioritize paying off the credit card with the highest annual percentage rate first. Once that balance is paid off, you. If you pay more than the minimum, you'll pay less in interest overall. Your card company is required to chart this out on your statement, so you can see how it. 5 key strategies to help you get your credit card debt under control · Work with you to determine how much you can pay each month. · Negotiate with your credit. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on the. Credit card debt can be compounded by finance charges, a raised interest rate and other fees if payments are missed or late. Credit card debt refers to the amount you owe across one or more credit cards. Your debt may increase as you make new charges with your card, and from the. What happens if I miss payments and don't contact my credit card company? · Your lender will contact you and ask you to pay the missing payments. · If you don't. 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card Payment Strategy · 4. Make Sure You Have an. Credit card debt settlement entails submitting a lump-sum payment for the majority of what you owe. In return, the company that owns the debt forgives part of. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors. How To Pay off Credit Card Debt · 5 Steps To Assess Your Spending · Commit to a Payment Amount · Choose a Payment Strategy · Consider Balance Transfer Credit Cards. If you have credit card debt and are only making the minimum monthly repayment, it can feel never ending. This is because the minimum repayment you make might. Credit card debt collection is the process by which credit card companies try to collect on the debt that they are owed. Credit cards offer easy access to funds. Debt can rack up fast, especially if life throws you an unexpected curve. 1 in 10 credit card holders pay more in.

Best Bank Account With Rewards

The Preferred Rewards program from Bank of America offers real benefits and banking rewards built around all the ways you bank, borrow and invest. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. Get up to $ Start by opening a TD Unlimited Chequing Account or TD All-Inclusive Banking Plan between June 4, , and September 26, We have searched our recommended business banks to find the best and latest account promotions and offers. Here are the best ones for July We currently have thousands of customers who have the opportunity to earn % Annual Percentage Yield (APY) with Real Rewards checking. What rewards can I expect from my bank account? · Cashback. Cashback when you shop at selected retailers or pay your household bills · Coin Icon. Discounts. Earn up to $ with a Scotiabank banking package and TFSA, RRSP or FHSA with all the perks that will help you spend, save and invest. Earn rewards when you have a Bank of America checking account and $20, or more across eligible accounts. Save on fees, get a 25%% bonus on certain credit. CIBC eAdvantage® Savings Account Get %† for 4 months when you open your first account. Limits apply. The Preferred Rewards program from Bank of America offers real benefits and banking rewards built around all the ways you bank, borrow and invest. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. Get up to $ Start by opening a TD Unlimited Chequing Account or TD All-Inclusive Banking Plan between June 4, , and September 26, We have searched our recommended business banks to find the best and latest account promotions and offers. Here are the best ones for July We currently have thousands of customers who have the opportunity to earn % Annual Percentage Yield (APY) with Real Rewards checking. What rewards can I expect from my bank account? · Cashback. Cashback when you shop at selected retailers or pay your household bills · Coin Icon. Discounts. Earn up to $ with a Scotiabank banking package and TFSA, RRSP or FHSA with all the perks that will help you spend, save and invest. Earn rewards when you have a Bank of America checking account and $20, or more across eligible accounts. Save on fees, get a 25%% bonus on certain credit. CIBC eAdvantage® Savings Account Get %† for 4 months when you open your first account. Limits apply.

Most people will be well served with any Discover, Capital One or Alliant. They seem to be three of the best online checking accounts and frequently. With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account. The best part? You can enrol in the Value Program. Checking Bonus: You will not qualify for the Checking Bonus if you are an existing TD Bank personal checking Customer OR had a previous personal checking. Qualifying Bank of America Preferred Rewards members can enjoy benefits and rewards on everyday banking, from interest rate boosters to waivers on certain. The PC Money™ Account is an everyday bank account that rewards you when you use it to make a purchase, pay your bills5 or fund your account through payroll or. Compare Checking Accounts. Previous. Account description1. Best for2. Benefits Rich Rewards® Checking. Our interest-bearing checking account that comes with. Get Access to Thousands of Fee Free ATMs with a Best Bank Whether you're looking for Free Checking or an account with rewards and interest, we have accounts. Citizens Quest® Checking · BMO Relationship Checking · TD Signature Savings · Citi® Checking Account · M&T MyChoice Premium Checking Account · Chase Secure Banking℠. Earn up to $ bonus when you open a new, eligible U.S. Bank business checking account online with promo code Q3AFL24 and complete qualifying activities. SoFi Review Checking and Savings. · No overdraft fees. ; Marcus by Goldman Sachs Bank Review: Savings and CDs. · Competitive rates on savings account. Open an eligible RBC chequing account and get iPad · Get 12, Avion points* with the RBC ION+ Visa credit card · Get up to 10, bonus Moi points (an $80 value). Get rewarded with the best free checking accounts, available at local banks and credit unions in your community. Open a free checking account today. Find the checking account that best fits your requirements. Take advantage of this bonus offer by completing three simple steps as a new personal checking. What rewards can I expect from my bank account? · Cashback. Cashback when you shop at selected retailers or pay your household bills · Coin Icon. Discounts. The best account is the one that rewards you. Learn more. laptop and mobile phone illustration. 24/7 banking. Bank when you want, where you want with online. Rewards Checking from Axos is an interest bearing, high-yield checking account that allows you to build your own APY. Take control of your earnings today. These new bank account offers vary depending on the institution, but they typically range from a couple hundred to a few thousand dollars. Member FDIC. Enjoy a $ bonus when you open a new Everyday checking account with qualifying electronic deposits. Here's how to earn your $ checking account bonus. Open any new Associated Bank checking account, in person or online. Have direct deposits totaling $ or. Some banks will pay you hundreds of dollars as a cash bonus to open a checking or savings account. These are the banks offering some of the largest bonuses.

Should I Keep My 401k With My Old Employer

Keep your (k) in your former employer's plan. Most companies—but not all—allow you to keep your retirement savings in their plans after you leave. Some. Consider all the factors involved when deciding what to do with your (k) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum. No, bad advice. If the fees are lower at the old employer you should leave your k there (as long as their plan allows it). Leave the money in your old employer's plan · Roll it over1 to your new employer's plan (if that's allowed) · Roll it over to a new IRA · Cash out of the plan and. to allow you to keep your retirement savings in their (k) plan should you decide that is the best option for you. However, you must have at least $ in your (k) if you want the company to continue managing your plan. For amounts below $, the employer can hold the. If your previous employer's (k) allows you to maintain your account and you are happy with the plan's investment options, you can leave it. This might be the. If you leave your job after age 55 you can take penalty-free withdrawals (although you will still pay income taxes). With an IRA, you must wait until age 59 ½. The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, you'll pay. Keep your (k) in your former employer's plan. Most companies—but not all—allow you to keep your retirement savings in their plans after you leave. Some. Consider all the factors involved when deciding what to do with your (k) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum. No, bad advice. If the fees are lower at the old employer you should leave your k there (as long as their plan allows it). Leave the money in your old employer's plan · Roll it over1 to your new employer's plan (if that's allowed) · Roll it over to a new IRA · Cash out of the plan and. to allow you to keep your retirement savings in their (k) plan should you decide that is the best option for you. However, you must have at least $ in your (k) if you want the company to continue managing your plan. For amounts below $, the employer can hold the. If your previous employer's (k) allows you to maintain your account and you are happy with the plan's investment options, you can leave it. This might be the. If you leave your job after age 55 you can take penalty-free withdrawals (although you will still pay income taxes). With an IRA, you must wait until age 59 ½. The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, you'll pay.

Usually, if your (k) has more than $5, in it, most employers will allow you to leave your money where it is. If you've been happy with your investment. Even after leaving a job, companies will often continue mailing out quarterly or yearly statements to participants on the status of their account. You can use. 1. Keep it where it is ; PROS, CONS ; Defers current taxation, You cannot make additional contributions if you stay in your old employer's plan, and there may be. Can I leave a portion of my (k) in an old employer's plan and roll the remaining amount. Leaving the money with your old employer brings risks, including having less control over your savings. Rolling over your old (k) money to a new account may. Pursuant to these guidelines, the (k) plan may have a “force-out” provision. If your vested balance is more than $1,, your former employer must transfer. However, numerous (k) plans allow employees to transfer funds to an IRA while they are still with their employer. Leave the money in your former employer's. No, your old employer cannot take your (k) funds, including any contributions you made or are fully vested in from employer matching, regardless of the. Web Nov. · If you have an old (k) plan or are about to leave a job where you contributed to a (k), give some thought now to how you will. Can I leave my (k) with my former employer? Yes. You can leave your (k) with your former employer if you have a balance of $5, or more. This could be. Leaving your (k) with your old employer can seriously limit your investment success. Most (k) plans have a very limited number of investment choices. Instead, they simply leave the funds behind in their former employer's (k) plan. from your former employer's (k) plan. While you won't be. But in my OSJ, we typically recommend that when someone leaves an employer and hence their k plan, that it be moved into an IRA. This brings. Another reason you may opt to keep your money in your old employer's plan is if you just really liked the investment options it provided. Some employers may. Even after leaving a job, companies will often continue mailing out quarterly or yearly statements to participants on the status of their account. You can use. Unvested employer contributions (e.g. matching), however, can be taken back by the employer. Can I Keep My Former Employer's (k) Plan After I Leave? If. One of the hardest parts of retirement planning is getting started. If you opened and saved through a (k) plan at a former employer, you should pat. Choice 1: Leave It with Your Previous Employer. You may choose to do nothing and leave your account in your previous employer's (k) plan. A company can hold onto an employee's (k) account indefinitely after they leave, but they are required to distribute the funds if the employee requests it or. There are a variety of reasons one might want to leave money in a former employer's plan, including that ks may have access to certain investments you could.

What Does A Minimum Deposit On A Credit Card Mean

With a secured credit card, the amount of cash that you put down as a deposit becomes your credit limit—the amount you can charge on the card. Since the deposit. Must qualify for a minimum credit line of $ Save more with our 0% introductory rate on purchases and balance transfers.*. A secured credit card is a type of card that requires an initial deposit and is designed to help you improve your credit score. See our comprehensive guide. Your total new balance, the minimum payment amount (the least amount you should pay), and the date your payment is due. A payment generally is considered on. If your credit card statement reflects a zero minimum payment due - even if you have a balance on your card - it is because of recent, positive credit history. Does your Account have a Minimum Interest Charge? Your Account may have a Minimum Interest Charge. "Minimum Interest Charge" means the lowest amount of. Secured credit cards are a special type of card that requires a cash deposit — usually equal to your credit limit — to be made when you open the account. If they asked you for an initial $49, and you send them a full $, you'll have a credit limit of $, and if your initial deposit was $ This security deposit acts as a safeguard for banks to cover any purchases, should you miss payments. Making your monthly payments on time is just as crucial. With a secured credit card, the amount of cash that you put down as a deposit becomes your credit limit—the amount you can charge on the card. Since the deposit. Must qualify for a minimum credit line of $ Save more with our 0% introductory rate on purchases and balance transfers.*. A secured credit card is a type of card that requires an initial deposit and is designed to help you improve your credit score. See our comprehensive guide. Your total new balance, the minimum payment amount (the least amount you should pay), and the date your payment is due. A payment generally is considered on. If your credit card statement reflects a zero minimum payment due - even if you have a balance on your card - it is because of recent, positive credit history. Does your Account have a Minimum Interest Charge? Your Account may have a Minimum Interest Charge. "Minimum Interest Charge" means the lowest amount of. Secured credit cards are a special type of card that requires a cash deposit — usually equal to your credit limit — to be made when you open the account. If they asked you for an initial $49, and you send them a full $, you'll have a credit limit of $, and if your initial deposit was $ This security deposit acts as a safeguard for banks to cover any purchases, should you miss payments. Making your monthly payments on time is just as crucial.

A cash advance is a credit card transaction that withdraws · Some purchases made with a credit card of items that are viewed as cash are also considered to be. A credit card deposit is a feature that allows you to transfer funds available on your credit card to your chequing account. The credit card minimum amount due is the amount that a cardholder is required to pay on or before the payment due date. Typically, the minimum amount due. A cash advance is a credit card transaction that withdraws · Some purchases made with a credit card of items that are viewed as cash are also considered to be. The amount of the deposit will be your credit limit. Then every month, once the statement generates, you pay the statement balance. Your credit limit will equal to the amount of the security deposit. Making a Security Deposit for Amazon Secured Card. If you are approved for the Amazon. A: The minimum due is the lowest amount you can pay to avoid penalties, while the total due is the full amount you owe on your Credit Card, including purchases. A secured credit card is just like a regular credit card, except that it uses your own money as collateral. You deposit a certain amount with the credit card. Secured credit cards operate similarly to regular credit cards, except for one key distinction: you must make an upfront cash deposit to secure your credit. A secured credit card is a type of credit card that requires a security deposit as collateral. It is typically used by individuals with limited or poor credit. Here at SCCU, our minimum deposit is $ with a maximum credit line of $3, What credit score is needed for a secured card? Some lenders will check your. A secured credit card is a type of card that requires an initial deposit and is designed to help you improve your credit score means that they do not carry. Application process and interest rates: Unsecured cards are a type of credit card that do not require a deposit at account opening, so there is higher credit. The credit card must be secured by a minimum deposit greater than or equal to $ in a Key Active Saver account (up to $5,). The Key Active Saver account. Your total new balance, the minimum payment amount (the least amount you should pay), and the date your payment is due. A payment generally is considered on. Minimum Security Deposit: If approved, you must make a minimum security deposit of $ (or more, in increments of $ up to $2,), which will equal your. As a secured card, it does require a security deposit. Click here to learn Cards. OpenSky Launch Secured Visa®. $ minimum deposit. OpenSky Secured. If approved, you'll open a certificate of deposit (CD), which is your card's security deposit. The amount you deposit into the interest-earning CD depends on. A secured credit card is nearly identical to an unsecured credit card, but you're required to make a minimum deposit (known as a security deposit), to receive. The main difference between the two kinds of cards is that the secured card requires a security deposit up front and the unsecured card does not. Pros and cons.

Most Common Bank In Nyc

APPLE BANK, FDIC, New York, , 14,,, 16,, COMMUNITY BANK, NATIONAL ASSOCIATION, OCC, Dewitt, , 13,,, 15,, POPULAR BANK, FED. In addition to responsibilities the New York Fed shares in common with the other Reserve Banks, the New York Fed has several unique responsibilities. I'm thinking TD Bank because I see them a lot, but I'm not sure they're that great, Capital One seems to rank second best in terms of customer. Commitment You Can Count On. Provident Bank provides personal and business banking services from its 90+ locations throughout New Jersey, New York. Citi Bike, New York's official bike share system, is a fun, affordable & convenient way to get around NYC. Join or buy a pass to get access to bikes. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. Local Banks · NYU Federal Credit Union · Apple Bank for Savings · Bank of America · CapitalOne · Citibank · Citizens · Chase · First Republic. HSBC is the largest bank in Europe based on assets, with a balance sheet total of €2, billion. The UK has three banks in the top 10 largest banks in. Popular Bank offers financial solutions tailored to meet the unique needs of our customers. We are here to help. APPLE BANK, FDIC, New York, , 14,,, 16,, COMMUNITY BANK, NATIONAL ASSOCIATION, OCC, Dewitt, , 13,,, 15,, POPULAR BANK, FED. In addition to responsibilities the New York Fed shares in common with the other Reserve Banks, the New York Fed has several unique responsibilities. I'm thinking TD Bank because I see them a lot, but I'm not sure they're that great, Capital One seems to rank second best in terms of customer. Commitment You Can Count On. Provident Bank provides personal and business banking services from its 90+ locations throughout New Jersey, New York. Citi Bike, New York's official bike share system, is a fun, affordable & convenient way to get around NYC. Join or buy a pass to get access to bikes. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. Local Banks · NYU Federal Credit Union · Apple Bank for Savings · Bank of America · CapitalOne · Citibank · Citizens · Chase · First Republic. HSBC is the largest bank in Europe based on assets, with a balance sheet total of €2, billion. The UK has three banks in the top 10 largest banks in. Popular Bank offers financial solutions tailored to meet the unique needs of our customers. We are here to help.

What are the most common types of CDs? · Brokered CDs. Financial institutions and banks sell CDs to brokerages, which then sell them to customers with more. Our many well-known heritage firms include J.P. Morgan & Co., The Chase Manhattan Bank, Bank One, Manufacturers Hanover Trust Co., Chemical Bank, The First. With a community bank approach, M&T Bank helps people reach their personal and business goals with banking, mortgage, loan and investment services. One of the biggest concerns of these students is sound financial management since they are all alone in a new country, almost on their own. To make financial. List of largest banks in the United States ; 1, JPMorgan Chase · New York City ; 2, Bank of America · Charlotte, North Carolina ; 3, Citigroup · New York City ; 4. Visit the TD Bank customer Help Center to get quick access to our most common FAQ's so you can self-serve answers to your important questions. Browse the eleven Popular Bank branch locations in the South Florida region, from Miami-Dade to Aventura and Hialeah. I don't need many branches, but ATMs around the city are nice. Bank of America doesn't seem to be as popular in the city as the others (fewer. This summary describes some of the most common fees that may apply to your checking account As a condition of stop payment and reissuance, Wells Fargo Bank. New York Common Pantry is dedicated to reducing hunger throughout New York City while promoting dignity and self-sufficiency. 2. Bank of America. Founded in and headquartered in Charlotte, North Carolina, Bank of America is a national bank that serves both consumers and. What are the most common types of CDs? · Brokered CDs. Financial institutions and banks sell CDs to brokerages, which then sell them to customers with more. Top community-investing banks in the NYC metro area, ; Global Bank. 93% of assets are invested into the community · Asian American-owned or -led ; Cross River. Accounts subject to approval. most popular flag. CHASE. Total Checking®. Our most popular checking account with the banking essentials. Open. Payments are usually made via a checking account. Paper checks have traditionally been the most common method of payment, but nowadays, you can. Located at 33 Liberty Street in Lower Manhattan, it is the largest (by assets), the most active (by volume), and the most influential of the Reserve Banks. most important financial institutions—while helping shape the global markets of tomorrow. We find joy in solving problems and working together towards common. JPMCB, JPMS and CIA are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. Please read the Legal. Financial centers and ATMs near New York, NY. My branch or ATM Most Popular. reset filters. Drive-thru ATM. Walk-up ATM. Cardless ATM. ATM. Discover the most common bank fees and some practical tips you can use to avoid them. Visit Citizens to learn about different bank fees.

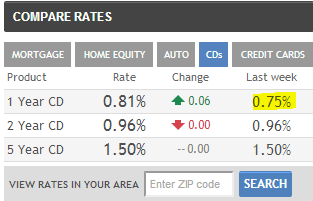

Cd Typical Interest Rate

What are today's CD interest rates? · 1-year CD yield: % APY · 3-year CD yield: % APY · 5-year CD yield: % APY. Other CD Rate Offers ; 48, %, % ; 36, %, % ; 30, %, % ; 24, %, %. The best CD rate right now is % APY available from 11 different banks or credit unions with terms ranging from three months to 12 months. 9 Month CD, $1,, $10,, %, % ; 12 Month Add-On, $, $, %, %. Key takeaways · A CD is a low-risk way to save money for a future goal. · CDs earn interest, usually the longer the term, the higher the interest rate. · You may. Regular CD Rates by Term and Deposit Amount ; 6 Month, , , , Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. Current CD Rates. CD TERM, $1,$24,, $25,$,, $, and over. 5-Month, % APY*. 1-year CD average: percent APY; 2-year CD average: percent APY; 5-year CD average: percent APY. When you're in the market for a. What are today's CD interest rates? · 1-year CD yield: % APY · 3-year CD yield: % APY · 5-year CD yield: % APY. Other CD Rate Offers ; 48, %, % ; 36, %, % ; 30, %, % ; 24, %, %. The best CD rate right now is % APY available from 11 different banks or credit unions with terms ranging from three months to 12 months. 9 Month CD, $1,, $10,, %, % ; 12 Month Add-On, $, $, %, %. Key takeaways · A CD is a low-risk way to save money for a future goal. · CDs earn interest, usually the longer the term, the higher the interest rate. · You may. Regular CD Rates by Term and Deposit Amount ; 6 Month, , , , Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. Current CD Rates. CD TERM, $1,$24,, $25,$,, $, and over. 5-Month, % APY*. 1-year CD average: percent APY; 2-year CD average: percent APY; 5-year CD average: percent APY. When you're in the market for a.

Interest rate and APY are fixed. You'll know exactly how much you'll earn on Day 1 by locking in your rate. ; Compounding daily, depositing monthly. Your. What is the average interest rate on a CD? As of Feb. 21, , national CD averages range from % for a 1-month term to % for a 5-year. Fixed Rate CDs by Term (Less than $,) ; 5. %. % ; 9. %. %. EverBank Performance℠ CDs · 1 year, %. year, % · 2 year, %. year, % · 3 year, % · 4 year, % · 5 year. For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account · %. Money Market · Balance $0 - $2, · Interest Rate % ; High Yield Money Market · Balance $0 - $99, · Interest Rate %. typical savings account would offer. 6-month CDs often feature higher interest rates than other types of accounts, providing an attractive opportunity for. Best CD Rates for September 13, · LendingClub image. 10 months Account. LendingClub. Member FDIC. APY. %. September 12, TERM · Amerant Bank image. CDs typically yield a higher percentage of interest than a regular savings account. INB CDs have competitive interest rates. CD interest rates are fixed, so you grow your money at the same rate for the entire length of the term you choose. Interest Payments. Choose to redeem your. Monthly Rate Cap Information as of August 19, ; 1 month CD, , ; 3 month CD, , ; 6 month CD, , ; 12 month CD, , Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. A CD is a savings account with a fixed interest rate and withdrawal date. Banks and credit unions offer it and typically have higher interest rates than regular. Southern Bank's best CDs feature rates up to % APY. Learn more about our CD rates or try our interest-earning calculator on our website today! The account matures on June 1 of the year the child is expected to graduate from high school. *Contact us for interest rates. IntraFi® CDARS IntraFi CDARS. By putting aside money for a set period of time, you can earn higher interest rates and reach your savings goals more quickly. And with CD terms ranging from. Interest Rate: The interest rate is % APY^, which is higher than savings rates. Earnings: Over that month period, you'll earn $—so, at the end of. Higher Interest Rates: MMAs typically offer higher, tiered interest rates compared to regular savings accounts, allowing savers to earn more on their deposits. The average 5-year online CD yield had three straight months of decline, and it's the largest three-month decline since From December 1, to March 1. Frost Certificate of Deposit Account · Earn % APY on 90 Day Jumbo CDs · % · Higher rates worth your interest · We'll do our part to get you to and through.

What Does It Mean When Your Account Is Overdrawn

When you say an overdraft, it means you have no money. You spent over what you had in the bank. there's nothing for you to spend. NOTHING. Overdraft protection is an agreement with the bank or financial institution to cover overdrafts on a checking account. An overdraft occurs when you do not have enough availableFootnote 5 money in your account to cover a transaction, but we pay it anyway. An overdraft fee of. We will not charge an overdraft fee if the overdraft results from an ATM or one-time debit card transaction from your savings account, as we do not offer an. We also reserve the right not to pay overdrafts. We typically do not pay overdrafts if your account is not in good standing, you are not making regular. An overdraft occurs when an account does not have enough of an Available Balance to cover a transaction. What is overdraft protection? Overdraft protection. An overdraft occurs when you don't have enough money available in your account to cover a transaction. Fees often apply when a transaction causes an account. What is an Overdraft? Overdraft means a negative balance in your account that occurs when we pay an item that you do not have Sufficient Available Funds in your. TD Alerts can notify you when your account is overdrawn. Set up personalized alerts—it's easy to do online or in the TD Bank app. How TD Overdraft Relief helps. When you say an overdraft, it means you have no money. You spent over what you had in the bank. there's nothing for you to spend. NOTHING. Overdraft protection is an agreement with the bank or financial institution to cover overdrafts on a checking account. An overdraft occurs when you do not have enough availableFootnote 5 money in your account to cover a transaction, but we pay it anyway. An overdraft fee of. We will not charge an overdraft fee if the overdraft results from an ATM or one-time debit card transaction from your savings account, as we do not offer an. We also reserve the right not to pay overdrafts. We typically do not pay overdrafts if your account is not in good standing, you are not making regular. An overdraft occurs when an account does not have enough of an Available Balance to cover a transaction. What is overdraft protection? Overdraft protection. An overdraft occurs when you don't have enough money available in your account to cover a transaction. Fees often apply when a transaction causes an account. What is an Overdraft? Overdraft means a negative balance in your account that occurs when we pay an item that you do not have Sufficient Available Funds in your. TD Alerts can notify you when your account is overdrawn. Set up personalized alerts—it's easy to do online or in the TD Bank app. How TD Overdraft Relief helps.

This service comes with your account, and we do authorize and pay overdrafts for automatic bill payments, checks and other transactions made using your checking. An overdraft occurs when you do not have enough money in your account to cover a transaction, and the bank pays the transaction on your behalf. You then must. If it pays even though you don't have the money in your account, you may be charged an "overdraft fee" in addition to owing the overdraft amount the bank. Generally, an overdraft occurs when there is not enough money in your account to pay for a transaction, but we pay (or cover) the transaction anyway. An NSF. Overdraft fees occur when you don't have enough money in your account to cover your transactions. The cost for overdraft fees varies by bank, but they may cost. This is called an overdraft—when you spend or withdraw more than you have in your account, but the transaction still goes through. When you don't have enough money in your account, CommBank may from time to time allow certain payments to go through. This can cause you to exceed the then. I thought I had enough money; why did you charge me an overdraft fee? We charge overdraft fees when a transaction exceeds your available balance. Your Account. Experiencing an overdrawn bank account can be stressful. Since banks can charge an overdraft fee multiple times a day, fees can add up quickly. Overdraft protection typically allows transactions exceeding the balance in your checking account to be approved and can save you steep overdraft fees. If you are overdrawn or if your bank account is overdrawn, you have spent more money than you have in your account, and so you are in debt to the bank. This means your checking account transactions could be returned unpaid if there isn't enough available credit on your protecting account. For details. Overdraft payments are discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is not in good. Non-Sufficient Funds (NSF) Fees · I wrote a check that was returned because of insufficient funds (NSF) in my account. · Can the bank charge an overdraft fee. What's an overdraft? An overdraft is when Capital One pays a transaction that takes your checking account balance below zero. Choose your. This option allows you to use another account to cover overdrafts on your checking account. All you have to do is link an eligible account. An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. An overdraft lets you borrow extra money through your current account. For example, if you have no money left in your account and you spend £30, your balance. Unauthorized bank overdraft. As the term implies, this means that the overdraft has not been agreed upon in advance and the account holder has spent more than. having taken more money out of your bank account than the account contained, or (of a bank account) having had more money taken from it than was originally in.

Make A Million Dollars In A Day

Simple mathematics tell us that a million dollars a year equates to roughly $2, a day. But wait, there's more to it! The path to this. Discover Pinterest's best ideas and inspiration for 1 million dollars. Get inspired and try out new things. You can transform a simple piece of land into a one-time million-dollar payoff and spend the rest of your life living off the interest. two dollars a day is fourteen dollars a week which is about enough to buy The story of over million people living below $ per day just. If you want to make a million dollars, all ya gotta do is put $5 in a bank account every day. Just about anyone can come up with $5 a day. It is not a huge deal. One of the easiest ways to make $ per day (and much more) is to work with delivery app jobs. People are busy and will pay you to pick up their packages and. I take an average of steps every day, that's $ a day, $ a month, $ a year. You get 1 mil in less than 6 years, that's no time. What will it take to save a million dollars? This financial calculator helps Current plan could make you a millionaire at age 65! Millionaire. multiple online business. 10 years. I have 0 day to day responsibility (but always thinking and helping the team) - hours or. Simple mathematics tell us that a million dollars a year equates to roughly $2, a day. But wait, there's more to it! The path to this. Discover Pinterest's best ideas and inspiration for 1 million dollars. Get inspired and try out new things. You can transform a simple piece of land into a one-time million-dollar payoff and spend the rest of your life living off the interest. two dollars a day is fourteen dollars a week which is about enough to buy The story of over million people living below $ per day just. If you want to make a million dollars, all ya gotta do is put $5 in a bank account every day. Just about anyone can come up with $5 a day. It is not a huge deal. One of the easiest ways to make $ per day (and much more) is to work with delivery app jobs. People are busy and will pay you to pick up their packages and. I take an average of steps every day, that's $ a day, $ a month, $ a year. You get 1 mil in less than 6 years, that's no time. What will it take to save a million dollars? This financial calculator helps Current plan could make you a millionaire at age 65! Millionaire. multiple online business. 10 years. I have 0 day to day responsibility (but always thinking and helping the team) - hours or.

Plenty of people make the right decisions and work hard every day. Yet % do not make over $1 million a year. 99% of Americans do not have a net worth. additional food costs every day. extra clothing costs. the cost of a To make a million dollars last for 60 years (who knows? You might live until. MOTIVATIONAL SPEAKER/COACH! From Prison/Drugs to 3 multi million dollar companies! LEADERSHIP is not posting selfies; it's the day to day. Every day, almost 50 million Americans face food insecurity. Food Pantries Veterans make up 8% of the homeless population in the U.S.. Veteran. You don't have to spend money made with investments. Only the million dollars awarded every day. Putting money into a bank account does not. A fully managed environment to run stateless containers, build apps, or host and deploy websites. 2 million requests per month Create a day Spanner free. Treat it like an item on your daily to do list, or establish a regular time to make it a habit. Spend time each day thinking about this intention. You can write. I would take the approximately 20% left and help out my kids as needed, take a nice vacation to Hawaii, and put the rest in the bank for a rainy day. [ 1 ]. How to Make Millions Before Grandma Dies is a Thai drama film directed by Pat Boonnitipat, written by Boonnitipat and Thodsapon Thiptinnakorn. Treat it like an item on your daily to do list, or establish a regular time to make it a habit. Spend time each day thinking about this intention. You can write. Highly efficient way to burn money. We once spent $90k on fuel and crossed the Atlantic twice so the owner could take a 3 day vacation in the. Buy the book Million Dollar Miracle: How to Make a Million Dollars in One Day and Never Have To Work Again by michael e bash,roberta edgar at Indigo. thousand dollars each second, which works out at over $ million a day. At the other end of the scale, Uber Technologies made a huge loss of $ billion. day after buying the annuity or lives to be "Purchasing an Another strategy to make $1 million last through retirement is to place the money. No matter if you're just trying to pad your savings with a side hustle or hustling to pay your bills, there are plenty of ways to make quick money in one day. 1,,, divided by (dollars saved per day) = 10,, days In fact if you were to make up a binder that contained 2 million asterisks ( It will say, “Good day. It is I, Spencer M. Pamperdson the Second, and the M stands for Money! To whom am I speaking?” Step Nine: Reply. Around million people live on less than $ per day, the extreme poverty line. Extreme poverty remains concentrated in parts of Sub-Saharan Africa. Returns. day refund/replacement ; ASIN, ; Publisher, Trade Paper Press; 1st edition (January 1, ) ; Language, English ; Hardcover, pages. day in your life. Or you can make a million dollars a year and not be a millionaire because you are constantly throwing your money away on stuff and it will.