kupibest24.ru Overview

Overview

Make A Mortgage Payment With Credit Card

Sign in to your kupibest24.ru account and choose the “Pay & transfer” option, then choose “Pay bills”. · Choose your Chase mortgage or home equity line of credit. This service allows you to make an online payment using funds you have on deposit at another financial institution. Payment is made by e-check or debit card. To sign up for our free Automated Payments Program and have your loan payments automatically deducted from your checking or savings account, including accounts. Can I make my mortgage payment using a credit card? No, you can't pay your mortgage with a credit card. However, you can make a free one-time payment or set up. Can I make my mortgage payment with a debit or credit card? No, we're not able to accept credit or debit cards as payment on a mortgage. You can make a secure credit card payment with Simple Pay. Effective September 1, , a 2% service charge of the payment amount will be applied. Mortgage. We accept payments drawn from a valid checking or savings account. Credit or debit cards are not accepted for mortgage payments. Can I pay my mortgage with my credit card? While you're unable to make a mortgage payment using a credit card or debit card, you can set up automatic. Yes, it is okay to pay your mortgage with a credit card. However, only you can decide if it is worth it or not. Make sure you run the numbers and consider all. Sign in to your kupibest24.ru account and choose the “Pay & transfer” option, then choose “Pay bills”. · Choose your Chase mortgage or home equity line of credit. This service allows you to make an online payment using funds you have on deposit at another financial institution. Payment is made by e-check or debit card. To sign up for our free Automated Payments Program and have your loan payments automatically deducted from your checking or savings account, including accounts. Can I make my mortgage payment using a credit card? No, you can't pay your mortgage with a credit card. However, you can make a free one-time payment or set up. Can I make my mortgage payment with a debit or credit card? No, we're not able to accept credit or debit cards as payment on a mortgage. You can make a secure credit card payment with Simple Pay. Effective September 1, , a 2% service charge of the payment amount will be applied. Mortgage. We accept payments drawn from a valid checking or savings account. Credit or debit cards are not accepted for mortgage payments. Can I pay my mortgage with my credit card? While you're unable to make a mortgage payment using a credit card or debit card, you can set up automatic. Yes, it is okay to pay your mortgage with a credit card. However, only you can decide if it is worth it or not. Make sure you run the numbers and consider all.

The bank account number from where you'd like the funds deducted to make your payment (We do not accept credit or debit cards). Pay by phone. Call Yes, but it's typically not a wise move. The convenience fee you'll pay to have a third party payment processor take your credit card payment. Still have questions about paying your mortgage? We've Form of payment must be by credit card or electronic charge to your checking or saving account. Mortgage lenders don't accept credit card payments directly. · If you have a Mastercard or Discover card, you may be able to pay your mortgage through a payment. Can I make my mortgage payment with a credit card? No, we're not able to accept credit or debit cards as payment on a mortgage. However, we do accept payments drawn from a valid checking or savings account and. At this time, borrowers cannot use a credit or debit card to make a payment on their Old National mortgage loan. Payments can only be accepted from a checking. Can I pay my mortgage with my credit card? While you're unable to make a mortgage payment using a credit card or debit card, you can set up automatic. Explore flexible credit-card payment options · Get support with your mortgage payments · More ways we can help. High-interest debt from credit cards or loans makes it hard to manage your finances. But if you're a homeowner, you can take advantage of your home's equity. No, we're not able to accept credit or debit cards as payment on a mortgage. However, we do accept payments drawn from a valid checking or savings account and. The majority of mortgage lenders prohibit direct credit card payments to avoid incurring transaction fees. Plus, most lenders discourage the idea of paying one. You can also make a payment like you've always done, including by phone at or at a Navy Federal branch or ATM. Use BMO Bill Pay to pay your BMO loan(s) or make payments to other companies such as phone bills, health club or credit card payments. · Customers can control. Can I pay by credit card? · Your card company may charge you fees and interest for making the payment · Once payments are made, they can't be refunded · Paying by. Yes, you can pay a mortgage with a credit card. Although your local mortgage lender won't let you swipe your Mastercard for your monthly payment. Regulation Z's Payment Crediting Rules for Open-End Credit, Credit Cards, and Closed-End Mortgage Payments When a consumer makes a credit card payment at a. You can make a secure credit card payment with Simple Pay. Effective September 1, , a 2% service charge of the payment amount will be applied. Mortgage. You cannot make a payment to Freedom Mortgage with a credit card. Where Can You Find the Amount of Your Mortgage Payment? You can find your payment amount by. Making a lump sum mortgage payment. “Home Sweet Mortgage-Free Home Collabria Credit Card · Qtrade Guided Portfolios · Qtrade Direct Investing.

Can You Roll A Traditional Ira Into A Roth

Converting a traditional IRA to a Roth IRA lets you transfer all or a portion of your traditional accounts into a Roth IRA. But it comes with a tax bill. If you are under age 59½, you may be subject to a 10% federal tax penalty if you withdraw money from your traditional IRA to pay the tax on the conversion. You. Want potential tax-free growth for retirement? If you have a traditional IRA or old (k), you have the option to turn it into a Roth IRA. We can help. Converting from a Roth IRA to a Traditional IRA is generally not done—you've already paid taxes on your funds in your Roth IRA, why pay them again in retirement. As long as taxes are paid on the conversion (i.e., pre-tax) amount, anyone can convert a traditional IRA, or other eligible retirement plan asset,Footnote 1 to. Transfer the assets by completing a mutual fund IRA Transfer Form or Brokerage IRA Transfer Form. Complete this IRA Roth Conversion Form. A Roth IRA conversion allows you, regardless of income level, to convert all or part of your existing traditional IRA funds to a Roth IRA. Allowable conversions. You can withdraw all or part of the assets from a traditional IRA and reinvest them (within 60 days) in a Roth IRA. The amount that you. As long as the money out of the traditional equals what goes into the Roth IRA, you are fine. Converting a traditional IRA to a Roth IRA lets you transfer all or a portion of your traditional accounts into a Roth IRA. But it comes with a tax bill. If you are under age 59½, you may be subject to a 10% federal tax penalty if you withdraw money from your traditional IRA to pay the tax on the conversion. You. Want potential tax-free growth for retirement? If you have a traditional IRA or old (k), you have the option to turn it into a Roth IRA. We can help. Converting from a Roth IRA to a Traditional IRA is generally not done—you've already paid taxes on your funds in your Roth IRA, why pay them again in retirement. As long as taxes are paid on the conversion (i.e., pre-tax) amount, anyone can convert a traditional IRA, or other eligible retirement plan asset,Footnote 1 to. Transfer the assets by completing a mutual fund IRA Transfer Form or Brokerage IRA Transfer Form. Complete this IRA Roth Conversion Form. A Roth IRA conversion allows you, regardless of income level, to convert all or part of your existing traditional IRA funds to a Roth IRA. Allowable conversions. You can withdraw all or part of the assets from a traditional IRA and reinvest them (within 60 days) in a Roth IRA. The amount that you. As long as the money out of the traditional equals what goes into the Roth IRA, you are fine.

Yes, you can roll a traditional IRA into a ROTH IRA. To avoid an early withdrawal penalty, have the two IRA managers handle the money without. The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to. You can choose to open a new Roth or traditional IRA, or you can roll into an existing IRA. You can roll over into an IRA you already have established with us. by TurboTax• • Updated 8 months ago · Same trustee transfer: When your IRAs are held at the same financial institution, you can tell the trustee to transfer. You can convert a traditional IRA to a Roth no matter your age. But if the conversion boosts your income, it could have taxing consequences. Under current law, all individuals have the option to convert all or part of their Traditional IRA assets to a Roth IRA. How do they work? · You are age 59½ or older at the time of the distribution · You qualify for a special purpose distribution for the purchase of a first home . Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan (including a SEP or SIMPLE IRA plan). Moreover, if tax rates increase between now and the time you retire, earning less income would not necessarily mean you'll owe less in income taxes. Your taxes. Common practice is to simply contact the administrator for your current retirement account and request a rollover to a Roth account (either at the same or. It's easy to convert your traditional IRA to a Roth IRA so you can enjoy tax-free withdrawals in retirement. A Roth conversion occurs when you move assets from a Traditional, SEP or SIMPLE IRA (collectively referred to as a Traditional IRA in this article) or an. IRA Conversions — You must complete IRA conversions (from a traditional to a Roth) by Dec. 31 of the calendar year. IRA Contributions — You can make IRA. You can do a partial conversion of your traditional IRA into a Roth IRA and pay tax only on the portion converted, Damaryan explained. In these turbulent times. What's your retirement date? Typically, you wouldn't convert a traditional IRA to a Roth IRA if your plan is to retire soon and start making withdrawals. Convert investments from your traditional IRA brokerage account If you hold ETFs (exchange-traded funds), individual stocks and bonds, or other investments in. The amount withdrawn from your traditional IRA must equal the amount you deposit in your Roth IRA. If taxes were withheld, you must make up the difference or. You can use a Roth conversion to convert existing retirement assets from a traditional IRA to a Roth IRA. Learn how to convert a Traditional IRA to a Roth IRA. Open the. R. screen in the · Enter 1 of the following items for a Roth conversion: Enter. 2 · Enter. X in the · Open the unit of the. R screen, and.

Online App To Borrow Money

Looking for the best mobile banking app? Millions of people use Dave for cash advances, side hustles, and banking accounts with fewer fees. Make the switch! Chime SpotMe is a financial app that offers cash advances up to $ It emphasizes its fee-free approach to borrowing money. Play Store. /5. Our cash loan app makes money borrowing even easier, connecting you to loan lenders who can deposit your funds as fast as on the next business day. A personal loan is an unsecured installment loan with a fixed interest rate that is repaid in equal monthly payments. You may be able to receive up to $45, Our same day loan app lets you get money fast. Small loan can really help you solve some instant cash issues which may occur unexpectedly. What is a paycheck advance app? A paycheck advance app allows you to use your smartphone to borrow money in between paychecks. Instead of running a credit. Loan or Borrow Money with Friends & Family · An Online Platform to Loan Money Worldwide · How Does Pigeon Work? · More videos on YouTube · Getting Started Is Easy. Spotloan is a better way to borrow extra money. It's not a payday loan The application process is fast as it is done completely online. Most people. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees. Looking for the best mobile banking app? Millions of people use Dave for cash advances, side hustles, and banking accounts with fewer fees. Make the switch! Chime SpotMe is a financial app that offers cash advances up to $ It emphasizes its fee-free approach to borrowing money. Play Store. /5. Our cash loan app makes money borrowing even easier, connecting you to loan lenders who can deposit your funds as fast as on the next business day. A personal loan is an unsecured installment loan with a fixed interest rate that is repaid in equal monthly payments. You may be able to receive up to $45, Our same day loan app lets you get money fast. Small loan can really help you solve some instant cash issues which may occur unexpectedly. What is a paycheck advance app? A paycheck advance app allows you to use your smartphone to borrow money in between paychecks. Instead of running a credit. Loan or Borrow Money with Friends & Family · An Online Platform to Loan Money Worldwide · How Does Pigeon Work? · More videos on YouTube · Getting Started Is Easy. Spotloan is a better way to borrow extra money. It's not a payday loan The application process is fast as it is done completely online. Most people. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees.

There's a big difference between getting quick cash you need and getting a payday loan. With quick cash through Gerald, you're getting a straightforward payment. Brigit offers instant cash advances between $50 and $ per pay period. With more than 4 million downloads, you'll often find Brigit ranking on the App Store. You can borrow instantly with online loans and financial products. In fact, % of Americans get loans from digital lenders. Advance the money you need with no credit check or late fees. It takes only minutes to download the Dave app, securely link your bank, and send the money to a. Need $ or more? Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees. Why LightStream stands out: LightStream — the online lending division of Truist Bank — offers personal loans ranging from $5, to $,, making it possible. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. Best personal loans that offer an online application process · Best overall: LightStream Personal Loans · Best for debt consolidation: Happy Money · Best for. An online loan, put simply, allows you to complete the entire borrowing process by submitting an application from a desktop computer or mobile device. Get a Personal Loan offer up to $, Cash Advance up to $, and more. MoneyLion, a leading financial tech co., is your trusted source for making. I have downloaded and checked out a number of lending apps online and in the app store and I will say thay Solo is HANDS DOWN the best and easiest way I have. Other popular apps include PaySense, MoneyTap, and CASHe, which provide instant loans tailored to various financial needs. These apps ensure a. A copy of the Cash App Terms of Service, and related policies, can be found here. Klover is a budgeting and cash advance app lets you borrow up to $ against upcoming paychecks. And I like Klover since it doesn't have any mandetory fees. EarnIn is an app that gives you access to the pay you've earned - when you want it. Get paid for the hours you've worked without waiting for payday. We're Bankrate's #1 app for saving money in ✨ Learn more · Oportun · Loans · Save · Credit cards · Locations. Log in. Loans. Personal loans · Secured. Get six-month installment loans online, instant cash advances, and more short-term personal loans up to $ today with Money Stash. Best Cash Advance Apps of · Best Overall, Best for Fast Funding With a Low Fee: Varo · Runner-Up Best Overall, Best for Flexible Loan Amounts: Payactiv · Also. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money.

Low Risk High Return

1. Money Market Funds · 2. Fixed Annuities · 3. Preferred Stocks · 4. Treasury Notes, Bills, Bonds and TIPS · 5. Corporate Bonds · 6. Dividend-Paying Stocks · 7. High. If your horizon is longer than 10 years, relatively higher-risk investments that offer the potential for higher returns, such as stocks, may be a consideration. ' High Returns from Low Risk is targeted at airport readers and casual investors, and is a quick read that makes a profound point: objectively, high volatility. You accept that the returns from your investments are likely to be low compared to the potential returns from investments that have a higher risk rating. Rising interest rates also usually mean lower stock prices, since investors put more money into interest-paying investments because they can get a strong return. A low-volatility portfolio has the potential to outperform while exposing investors to less risk. Which investments are the safest? · 1. Savings bonds · 2. Treasury bonds, bills, notes & TIPS · 3. Money market accounts · 4. High-yield savings accounts · 5. Short-. High-yield savings accounts · I bonds · No-penalty CDs · Treasury bills · Preferred stocks · Money market accounts · Corporate and municipal bonds · Cash mananegement. Using this principle, individuals associate low levels of uncertainty with low potential returns, and high levels of uncertainty or risk with high potential. 1. Money Market Funds · 2. Fixed Annuities · 3. Preferred Stocks · 4. Treasury Notes, Bills, Bonds and TIPS · 5. Corporate Bonds · 6. Dividend-Paying Stocks · 7. High. If your horizon is longer than 10 years, relatively higher-risk investments that offer the potential for higher returns, such as stocks, may be a consideration. ' High Returns from Low Risk is targeted at airport readers and casual investors, and is a quick read that makes a profound point: objectively, high volatility. You accept that the returns from your investments are likely to be low compared to the potential returns from investments that have a higher risk rating. Rising interest rates also usually mean lower stock prices, since investors put more money into interest-paying investments because they can get a strong return. A low-volatility portfolio has the potential to outperform while exposing investors to less risk. Which investments are the safest? · 1. Savings bonds · 2. Treasury bonds, bills, notes & TIPS · 3. Money market accounts · 4. High-yield savings accounts · 5. Short-. High-yield savings accounts · I bonds · No-penalty CDs · Treasury bills · Preferred stocks · Money market accounts · Corporate and municipal bonds · Cash mananegement. Using this principle, individuals associate low levels of uncertainty with low potential returns, and high levels of uncertainty or risk with high potential.

Investing in low-risk stocks gives surprisingly high returns, significantly better than those generated by high-risk stocks. With more time to ride out stock market ups and downs, you could withstand higher risks, such as a heavier investment in growth stocks or high-yield bonds to. Low Risk · Aim to provide a return in line with, or slightly better than, deposits · They involve very little risk to investors' capital, provided certain. Based on historical data, holding a broad portfolio of stocks over an extended period of time (for instance a large-cap portfolio like the S&P over a 5 types of low-risk investments · 1. Treasury bills, Treasury notes and TIPs · 2. Fixed annuities · 3. Money market funds · 4. Corporate bonds · 5. Series I savings. The reward for taking on risk is the potential for a greater investment return. If you have a financial goal with a long time horizon, you may make more. The level of risk is tied to the potential level of return. If an investment is not expected to earn as much, it may be considered lower risk. Low risk investment options · FD. Fixed deposits (FDs) are well-suited for the risk averse investor. · PPF. The Public Provident Fund (PPF) is a government. List of Best Low Risk Mutual Funds in India sorted by Returns ; Quant Multi Asset Fund · ₹2, Crs ; ICICI Prudential Equity & Debt Fund · ₹39, Crs ; ICICI. List of Best Low Risk Mutual Funds in India sorted by Returns ; Quant Multi Asset Fund · ₹2, Crs ; ICICI Prudential Equity & Debt Fund · ₹39, Crs ; ICICI. High-risk investments may offer the chance of higher returns than other investments might produce, but they put your money at higher risk. Here we have discussed some smart investment options that can maximize the returns with minimum risk involved. Low risk investment options · FD. Fixed deposits (FDs) are well-suited for the risk averse investor. · PPF. The Public Provident Fund (PPF) is a government. When interest rates are high and inflation is low, investing is a cinch: savers can earn easy returns by simply parking their funds in Treasury bills or similar. Whether or not it's a good idea for you to shift asset allocation right now; Which are the lowest-risk investment options you can add to your portfolio ; Equity. High-risk investments may offer the chance of higher returns than other investments might produce, but they put your money at higher risk. The reward for taking on risk is the potential for a greater investment return. low and sell high. You can rebalance your portfolio based either on the. Low risk, high return in a short span of time = usually scam/ponzi schemes. Personally, investing in real estate is not low risk. Learn the ropes in detail. You know that you have to look for investments that provide a comfortable balance of high return and low risk. Low risk means that there is a reduced chance of. Low risk, high return in a short span of time = usually scam/ponzi schemes. Personally, investing in real estate is not low risk. Learn the ropes in detail.

Employee Withholding Certificate How To Fill Out

Form NC-4 Employee's Withholding Allowance Certificate. Frequently Asked Questions About Traditional and Web Fill-In Forms · IFTA. Employee's Withholding Exemption and County Status Certificate. This form is Instructions for Completing Form WH This form should be completed by. Learn how to fill out Form W-4, Employee Withholding Certificate Form to avoid a big tax bill. Also, learn the difference between W-4 and W-2 forms. Form (G4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Step-by-Step Gide to Filling Out a W · Step 1: Provide Your Information · Step 2: Indicate Multiple Jobs or a Working Spouse · Step 3: Add Dependents · Step. Notice to Employee: Return completed form to your Employer. Consider completing a new Form MO W-4 each year and when your personal or financial situation. The W-4 form uses a system of allowances that are used to calculate the correct amount of tax to withhold. The more allowances you report on the W-4, the less. completing a new Nebraska Form W-4N. If you are an employee claiming exemption from withholding, skip lines 1 and 2, write “exempt” on line 3, and sign the. To claim exempt, write EXEMPT under line 4c. • You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income. Form NC-4 Employee's Withholding Allowance Certificate. Frequently Asked Questions About Traditional and Web Fill-In Forms · IFTA. Employee's Withholding Exemption and County Status Certificate. This form is Instructions for Completing Form WH This form should be completed by. Learn how to fill out Form W-4, Employee Withholding Certificate Form to avoid a big tax bill. Also, learn the difference between W-4 and W-2 forms. Form (G4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Step-by-Step Gide to Filling Out a W · Step 1: Provide Your Information · Step 2: Indicate Multiple Jobs or a Working Spouse · Step 3: Add Dependents · Step. Notice to Employee: Return completed form to your Employer. Consider completing a new Form MO W-4 each year and when your personal or financial situation. The W-4 form uses a system of allowances that are used to calculate the correct amount of tax to withhold. The more allowances you report on the W-4, the less. completing a new Nebraska Form W-4N. If you are an employee claiming exemption from withholding, skip lines 1 and 2, write “exempt” on line 3, and sign the. To claim exempt, write EXEMPT under line 4c. • You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income.

Notice to Employee: Return completed form to your Employer. Consider completing a new Form MO W-4 each year and when your personal or financial situation. Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary. Instructions: Employees who are subject. Who must file a Form D-4? Every new employee who resides in DC and is required to have DC income taxes withheld, must fill out Form D-4 and file it with his/her. Read the instructions on Page 2 before completing this form. • Select Form CT-W4, Employee's Withholding Certificate, provides your employer with. Employee's Withholding Certificate. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your. Employee's Withholding Certificate. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your. You must provide a copy of the employee's spousal military identification card issued to the employee by the Department of Defense when completing the IT 4. Employees fill out a W-4 form to inform employers how much tax to withhold from their paychecks. · The amount withheld is based on filing status, dependents. HOW TO CLAIM YOUR WITHHOLDING EXEMPTIONS. 1. Your personal exemption. Write the figure “1.” If you are age 65 or over or will be before next year, write “2”. completing a new Nebraska Form W-4N. If you are an employee claiming exemption from withholding, skip lines 1 and 2, write “exempt” on line 3, and sign the. • Write to. ILLINOIS DEPARTMENT OF REVENUE. PO BOX SPRINGFIELD IL IL-W-4 Employee's Illinois Withholding Allowance Certificate. ____ ____. Form (G4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Even employees who have recently updated their W-4s should make sure that they have completed the most recent version of the W-4VT. Am I required to fill out. • Write to. ILLINOIS DEPARTMENT OF REVENUE. PO BOX SPRINGFIELD IL IL-W-4 Employee's Illinois Withholding Allowance Certificate. ____ ____. For additional information consult your employer or write to: Arkansas Withholding Tax Section. P. O. Box Little Rock, Arkansas AR4EC (R HOW TO CLAIM YOUR WITHHOLDING EXEMPTIONS. 1. Your personal exemption. Write the figure “1.” If you are age 65 or over or will be before next year, write “2”. Form NC-4 Employee's Withholding Allowance Certificate. Frequently Asked Questions About Traditional and Web Fill-In Forms · IFTA. Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages. If you do not. The new form has five steps. Employees must fill out step 1 and step 5. Steps 2, 3, and 4 are optional, but completing them will ensure that your tax. Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary. Instructions: Employees who are subject.

My Agi Is Correct But Rejected 2020 Turbotax

If your return was rejected for an AGI or PIN mismatch, it means that what you entered doesn't match their records. The IRS only requires one of these to match. Q: Where can I find more information on free online filing of federal income tax returns? A: If your adjusted gross income was $66, or less, free e-filing. In response to the rejection of an electronically filed return that's missing the Form , taxpayers may refile a complete return by completing and attaching. Visit OkTAP at kupibest24.ru and click on the “Where's My Refund?” link to establish the use tax due based on your Federal AGI from Form , line 1. If you're still having trouble, we suggest that you check with the IRS to make sure that the copy of your return is the same as what they have in their records. If you receive a letter asking for missing information or documentation to support what you claimed on your return, it doesn't mean you did anything wrong. Personal Exemption Amount - The exemption amount of $3, begins to be phased out if your federal adjusted gross income is more than $, ($, for. General Instructions. If you discover an error after filing your return, you may need to amend your return. Use Form X to correct a. If you receive a letter asking for missing information or documentation to support what you claimed on your return, it doesn't mean you did anything wrong. If your return was rejected for an AGI or PIN mismatch, it means that what you entered doesn't match their records. The IRS only requires one of these to match. Q: Where can I find more information on free online filing of federal income tax returns? A: If your adjusted gross income was $66, or less, free e-filing. In response to the rejection of an electronically filed return that's missing the Form , taxpayers may refile a complete return by completing and attaching. Visit OkTAP at kupibest24.ru and click on the “Where's My Refund?” link to establish the use tax due based on your Federal AGI from Form , line 1. If you're still having trouble, we suggest that you check with the IRS to make sure that the copy of your return is the same as what they have in their records. If you receive a letter asking for missing information or documentation to support what you claimed on your return, it doesn't mean you did anything wrong. Personal Exemption Amount - The exemption amount of $3, begins to be phased out if your federal adjusted gross income is more than $, ($, for. General Instructions. If you discover an error after filing your return, you may need to amend your return. Use Form X to correct a. If you receive a letter asking for missing information or documentation to support what you claimed on your return, it doesn't mean you did anything wrong.

Note: The AGI here is only used to verify your identity. If the IRS has for some reason not updated your correct AGI, then they will have stored it as. This signifies that the return must be printed and mailed to the correct agency (state, federal or both). The IRS filing addresses can be found on the IRS. your federal return has been adjusted either by the Internal Revenue Service (IRS) or on a X, Amended U.S. Individual Income Tax Return, you filed; the. What should I attach to my separately filed homestead credit claim? I received Medicaid waiver payments, which are excluded from federal adjusted gross income. Log into your Turbotax account. Ensure you select the appropriate year for your tax return. Click Fix My Return. Click revisit. You will see the. Log into your Turbotax account. Ensure you select the appropriate year for your tax return. Click Fix My Return. Click revisit. You will see the. Personal Exemption Amount - The exemption amount of $3, begins to be phased out if your federal adjusted gross income is more than $, ($, for. The prior-year adjusted gross income (AGI) you entered; Your prior-year tax records. If these don't match, the IRS will reject your return. In most cases, you. Personal Exemption Amount - The exemption amount of $3, begins to be phased out if your federal adjusted gross income is more than $, ($, for. I live in New Jersey but work in Pennsylvania. My employer withheld Pennsylvania income tax from my wages. What do I do? What are the mailing addresses for. We found an error on your tax return in your calculation of total contributions. As a result, we revised your contribution and refund amounts. Gather: Your. You can troubleshoot by finding your rejection code. It's in the email you received, or you can view it in TurboTax after signing in and selecting Fix my. If you filed your return by the due date and it gets rejected, the IRS will consider it filed on time if you make the necessary corrections and e-file it again. There may be aspects of your return which require further review, or possibly an audit. We also randomly select tax returns for audit, and those returns which. If the IRS rejects your return, sign in to your account and you should be taken directly to a screen explaining why your return was rejected and how to fix. If your return was rejected due to Adjusted Gross Income (AGI), your AGI from the prior year doesn't match the number in the IRS e-file database. Visit OkTAP at kupibest24.ru and click on the “Where's My Refund?” link to establish the use tax due based on your Federal AGI from Form , line 1. If your tax preparer is an authorized IRS e-file provider, your preparer can electronically file your federal and Oregon returns. Many Tax-Aide and Tax. If you e-filed in and have verified the correct AGI from Line 11 of your return (and are not entering a PIN) and still get rejected, try clicking I am. We found an error on your tax return in your calculation of total contributions. As a result, we revised your contribution and refund amounts. Gather: Your.

How To Get 35 Pdus For Pmp Certification Free

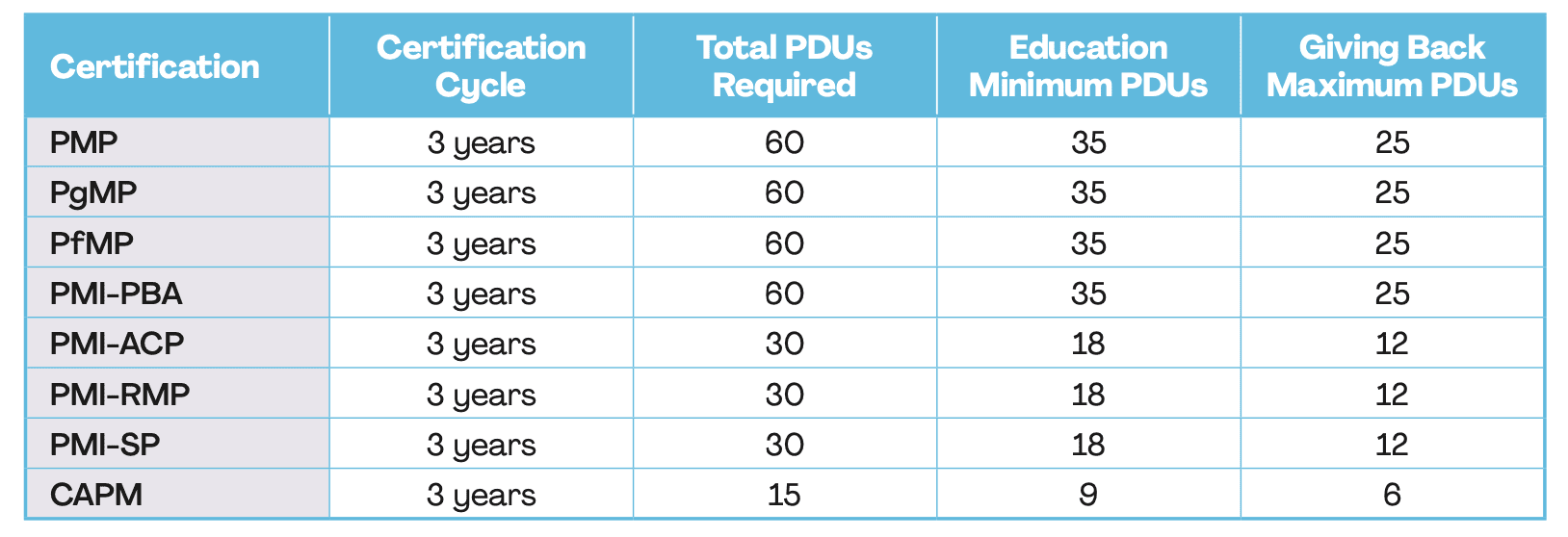

The MASTERCLASS to pass PMP Certification Exam | Aligned to PMBOK 7th Ed. and syllabus | 35 PDUs for PMP Exam. Registered PMI® members also get free access to Practice Exams. How many Earn the required 35 PDUs to take the PMP certification exam. Who should. You can earn PDUs by attending training programs offered by PMI Authorized Training Partners or by organizations or universities. Whenever you. Project Management Professional (PMP)® certification requires 60 PDUs. • Certifications like the Agile Certified Professional (PMI-ACP)® require 30 PDUs. Check. Prepare for the PMP® certification exam with our interactive course. Earn 35 PDUs to meet the project management education/training prerequisite to qualify for. Free access to our online PMP Exam Prep E-Learning Course ($ value) right after you register, 40 Hours of content; Live assistant filling out the PMP. The PMP certificate is awarded by PMI (Project Management Institute) to professionals who pass the PMP certification exam. There are certain PMP requirements. Attending conferences, online PMP PDU courses, Training, and webinars, reading a book or author, and so on are all options. To learn more about it, you can earn. More videos on YouTube · Post navigation · More videos on YouTube · Sonia Pabley, CAPM · Bipul Chandra Roy, PMP · Aadil Feroze, PMP · Sonia Pabley, CAPM · Ganesha. The MASTERCLASS to pass PMP Certification Exam | Aligned to PMBOK 7th Ed. and syllabus | 35 PDUs for PMP Exam. Registered PMI® members also get free access to Practice Exams. How many Earn the required 35 PDUs to take the PMP certification exam. Who should. You can earn PDUs by attending training programs offered by PMI Authorized Training Partners or by organizations or universities. Whenever you. Project Management Professional (PMP)® certification requires 60 PDUs. • Certifications like the Agile Certified Professional (PMI-ACP)® require 30 PDUs. Check. Prepare for the PMP® certification exam with our interactive course. Earn 35 PDUs to meet the project management education/training prerequisite to qualify for. Free access to our online PMP Exam Prep E-Learning Course ($ value) right after you register, 40 Hours of content; Live assistant filling out the PMP. The PMP certificate is awarded by PMI (Project Management Institute) to professionals who pass the PMP certification exam. There are certain PMP requirements. Attending conferences, online PMP PDU courses, Training, and webinars, reading a book or author, and so on are all options. To learn more about it, you can earn. More videos on YouTube · Post navigation · More videos on YouTube · Sonia Pabley, CAPM · Bipul Chandra Roy, PMP · Aadil Feroze, PMP · Sonia Pabley, CAPM · Ganesha.

Complete PMP Certification Course - Get 35 PDUs/Contact Hours - PMP Exam Training PMBOK 7 - Project Management. Earn 60 Free PDUs for PMP renewal from The PM Podcast. No registration required. Earn your first free PMP PDU right now. Fully aligned with the PMI Talent. This course satisfies the requirement of 35 PDUs to take the PMP exam. With Learning Tree's PMP Exam Prep Guarantee, you get unlimited free course retakes to. Should have spent 35 hours online going through the entire course content. · Should attempt the Full Length PMP® Simulation Test · Write to us at support@. Earn 35 Contact Hours of PMP Exam Prep. Every hour you sit in a class, training program, seminar, or another similar learning activity gives you one contact. Free access to our online PMP Exam Prep E-Learning Course ($ value) right after you register, 40 Hours of content; Live assistant filling out the PMP. PMP Certification Exam Prep Course 35 PDU Contact Hours Get your PMP Certification with this course PMP exam, please feel free to ping. Enroll in Free PMP® Training online and learn all you need to know about PMP certification. · Sample lectures from 35 contact hours online PMP training. This PMP® Online Self-paced course provides comprehensive preparation to get you ready for the PMP® certification exam. certification exam and awards a course completion certificate along with a certificate mentioning that you have earned the requisite 35 PDUs, making you. Almost all PMI Certifications including the PMP require PDU credits to renew. Click here to learn how to earn PDUs and renew your certification. Get more with paid PMI Project Management Professional (PMP) courses · Most popular · PMP Exam Prep Seminar - Complete Exam Coverage with 35 PDUs · PMP. There are several free courses, webinars, and events that you can attend and earn PDUs toward renewing your PMP certification. However, earning all required You will need a total of 60, the Gold package will get you there. Related products. CAPM Exam Simulator. $ Add to cart. Earn 35 PDUs/Contact Hours by completing the entire course · You will get all the resources you need to pass the PMI PMP certification exam. · You. If you are a paid PMI member, you have access here to lots of webinars, so you can watch and PDU's will be reported automatically. 1 hour = 1 PDU. Passing the PMP certification exam is a must for any individual looking to move up the corporate ladder in any company. This course will cover all the topics. Upon completing this program Rutgers Center for Supply Chain Management is authorized to issue 35 PDUs, a minimum requirement to appear for the certifications. Listen to the People and Projects Podcast! I recently ran into a guy who had worked diligently to get his Project Management Professional (PMP)® certification. 35 hours of Project Management Education · 35 PMI Approved Contacts hours/PDU Certificate needed to take your PMP exam. · Based on the PMBOK Guide7th Edition.

Monthly Payment 15 Year Vs 30 Year

If you can afford the higher monthly payment, a year mortgage can certainly pay off financially. But remember, buying a house isn't a completely financial. Generally, a year mortgage means higher monthly payments. This means you'll be able to pay the loan off faster and pay less interest over the life of the. While a year mortgage can make your monthly payments more affordable, a year mortgage generally costs less in the long run. Determining which mortgage term is right for you can be a challenge. With a shorter year mortgage, you will pay significantly less interest than a. A year mortgage allows you to pay off your mortgage in half the time of a year mortgage. It typically comes with a lower interest rate. While the year mortgage pays off twice as fast as a year mortgage, you'll notice the monthly payment isn't twice as much, thanks to how much you save in. The difference in rates is currently only %, or $/ month. Keep in mind neither of these include insurance and taxes, which are likely to. Can You Make Extra Payments on a Year Mortgage? Yes. Most lenders will allow you to pay them more each month than the minimum required. This means that you. year mortgages may offer the lowest monthly payment, but have higher interest rates than year mortgages · year mortgages typically have a lower rate. If you can afford the higher monthly payment, a year mortgage can certainly pay off financially. But remember, buying a house isn't a completely financial. Generally, a year mortgage means higher monthly payments. This means you'll be able to pay the loan off faster and pay less interest over the life of the. While a year mortgage can make your monthly payments more affordable, a year mortgage generally costs less in the long run. Determining which mortgage term is right for you can be a challenge. With a shorter year mortgage, you will pay significantly less interest than a. A year mortgage allows you to pay off your mortgage in half the time of a year mortgage. It typically comes with a lower interest rate. While the year mortgage pays off twice as fast as a year mortgage, you'll notice the monthly payment isn't twice as much, thanks to how much you save in. The difference in rates is currently only %, or $/ month. Keep in mind neither of these include insurance and taxes, which are likely to. Can You Make Extra Payments on a Year Mortgage? Yes. Most lenders will allow you to pay them more each month than the minimum required. This means that you. year mortgages may offer the lowest monthly payment, but have higher interest rates than year mortgages · year mortgages typically have a lower rate.

Determining which mortgage term is right for you can be a challenge. With a 15 year mortgage you will pay significantly less interest, but only if you can. Generally, that's how much higher mortgage interest rates are on year versus year mortgages, about 10–20% higher. So if your year rate. While a year mortgage can make your monthly payments more affordable, a year mortgage generally costs less in the long run. Let's use your numbers. A mortgage of k at 30 years is $ A 15 year is $4, That's a difference of essentially $ per month or 12k. A year mortgage allows you to pay off your mortgage in half the time of a year mortgage. It typically comes with a lower interest rate. Interest rates for year mortgages are typically lower than rates for year mortgages, so you'll pay less in interest but have a higher monthly payment. However, your monthly payments on a year mortgage will be higher. Mortgage Amount. Annual Interest Rate (30 Year Term). Year vs. Year Term Mortgage Calculator. Compare how the term of your loan affects the monthly payment and total cost. Monthly principal and interest payment (PI). Both year fixed and year fixed mortgages are shown. Total payments. Total of all monthly payments made over. What Are Today's Mortgage Rates? ; year fixed-rate mortgage: · The average APR for the benchmark year fixed-rate mortgage fell to %. · %. ; year. Interest rates for year mortgages are typically lower than rates for year mortgages, so you'll pay less in interest but have a higher monthly payment. The interest rates for year mortgages are slightly higher than year loans at % on average as of June 22, With a year loan, it will take you. The main difference between a 15 year vs 30 year mortgage is whether you want to pay more upfront and save on overall costs, or have easier monthly payments for. Do You Pay More Interest on a or Year Mortgage? One percentage point may not seem like much of a difference—but keep in mind, a year mortgage has. A big difference between a 15 and year mortgage is the amount of time it takes to pay them each off. Depending on your financial situation. Generally, year mortgages tend to have lower interest rates compared to year mortgages. However, monthly payments on a year mortgage are higher due to. 1. Monthly Payments. There's likely to be a substantial difference between the monthly payment on a year mortgage versus a year mortgage. Since you. Even though a year mortgage comes with a lower interest rate, your monthly payment for such a loan will be higher than it would be with a year fixed-rate. Affordability of vs. Year NJ Home Loans · A year mortgage generally provides lower interest rates but a higher monthly mortgage payment. · A year. The year mortgage: · Less actual net compound** cost · Higher interest rate · Longer time, lower payment, higher monthly savings · Any additional cash flow.

90 Day Ticker Carnival Cruise

We offer all Carnival cruises, along with every discount, deal and promotion. Find the lowest rates and best service here! day Grand Africa Voyage on Seabourn Sojourn. The bespoke, curated program will feature a brand-new collection of cast shows, 28 guest entertainers, and. Our 90 Day Ticker offers a vast selection of unpublished cruise discounts, with even deeper markdowns on select sailings. When you book through Pavlus Travel. cruise ship without worrying about the extras with free premium dining, and essential drinks included in the cruise price! Unmatched Value and Cruise Prices. Our world-famous Day Ticker is a complete listing of last-minute cruises on the world's best cruise lines. If you see a cruise there that interests you, don'. cruise planners. Our exclusive Day Ticker lists last minute cruise discounts on all cruise lines and cruise ships. We're already working on fixing it up — check back a little bit later, or give us a call now at CARNIVAL. To get your cruise fix in the meantime, visit us. So today we are boarding the Carnival Conquest for a last minute Father's Day cruise Day Ticker" Completa el formulario, ¡y listo! Encontrarás. I opened as an example FastDeal# on the 90 day ticker for a cruise with Norwegian Escape. Carnival cruise line casino cash out is a scam. We offer all Carnival cruises, along with every discount, deal and promotion. Find the lowest rates and best service here! day Grand Africa Voyage on Seabourn Sojourn. The bespoke, curated program will feature a brand-new collection of cast shows, 28 guest entertainers, and. Our 90 Day Ticker offers a vast selection of unpublished cruise discounts, with even deeper markdowns on select sailings. When you book through Pavlus Travel. cruise ship without worrying about the extras with free premium dining, and essential drinks included in the cruise price! Unmatched Value and Cruise Prices. Our world-famous Day Ticker is a complete listing of last-minute cruises on the world's best cruise lines. If you see a cruise there that interests you, don'. cruise planners. Our exclusive Day Ticker lists last minute cruise discounts on all cruise lines and cruise ships. We're already working on fixing it up — check back a little bit later, or give us a call now at CARNIVAL. To get your cruise fix in the meantime, visit us. So today we are boarding the Carnival Conquest for a last minute Father's Day cruise Day Ticker" Completa el formulario, ¡y listo! Encontrarás. I opened as an example FastDeal# on the 90 day ticker for a cruise with Norwegian Escape. Carnival cruise line casino cash out is a scam.

7 Day Cruise from Miami · Cruise from NY · Cruise from Tampa · Cruise from Rome · Carnival Cruises Out of Galveston. Find Your Perfect Cruise. Bermuda Cruises. Cruise Lines. American Cruise Lines · P&O Cruises · Atlas Ocean Voyages · Paul Day Ticker The world's best last-minute cruise markdowns. Find a Bargain. The company operates nine cruise line brands with over 90 ships visiting more than ports annually. Each day, more than , guests sail aboard its ships. Our 90 Day Ticker offers a vast selection of unpublished cruise discounts, with even deeper markdowns on select sailings. When you book through Pavlus Travel. Get the best prices and discounts on last-minute cruises! Don't wait - book before these deals sail away. Get the best prices and discounts on last-minute cruises! Don't wait - book before these deals sail away. Whether you are looking for a short three to four-day cruise, or you wish to If you are looking for a cruise that departs in more than 90 days, use. Carnival Cruise Line Please give us a call and we'll be happy to help! Alan Fox Executive Chairman Vacations To Go. Our Best Price & Service Guarantee. Day. Our exclusive Day Ticker lists last minute cruise discounts on all cruise lines and cruise ships. Carnival Cruise - Newest Five Day Menus. Explore exciting last-minute cruises with Carnival's unbeatable cruise deals. Don The best time to find a last-minute cruise deal is usually about 60 to We offer all Carnival cruises, along with every discount, deal and promotion. Find the lowest rates and best service here! 4 Night Bahamas & Perfect Day Cruise. Starting from* $/person. Taxes & fees Texas Galveston Carnival Pier. CRUISES. Carnival Imagination Cruises: Read Carnival Imagination cruise reviews We got the super cheap 90 day ticker rate for this three night cruise over. Their Day Ticker shows fares getting cheaper the closer the cruise gets to the embarkation date. Day Ticker The world's best last-minute cruise markdowns. Find a Bargain We suggest that you plan to arrive at least one or two days in advance of your. Labor Day Sale: Kids Sail Free Labor Day Sale: Kids Sail Free As an Carnival Cruise Line. Carnival Breeze. /rating out of 5 (3, reviews). 4. Britain, etc. But we always get free airfare by taking turns to each open up a credit card in our own name and spend the minimum for 90 day period to each get. Carnival Cruise Line, a Carnival Corp. unit, is laying off more than Catching the Wave: Carnival PLC's Stock's Dramatic 16% Leap in 90 Days. Carnival Cruise Line. You also probably won't find many Gray Faust says the window for finding last-minute cruise deals is within 90 days of a sailing. Whether you are looking for a short three to four-day cruise, or you wish to If you are looking for a cruise that departs in more than 90 days, use.

Vanguard Sp Etf

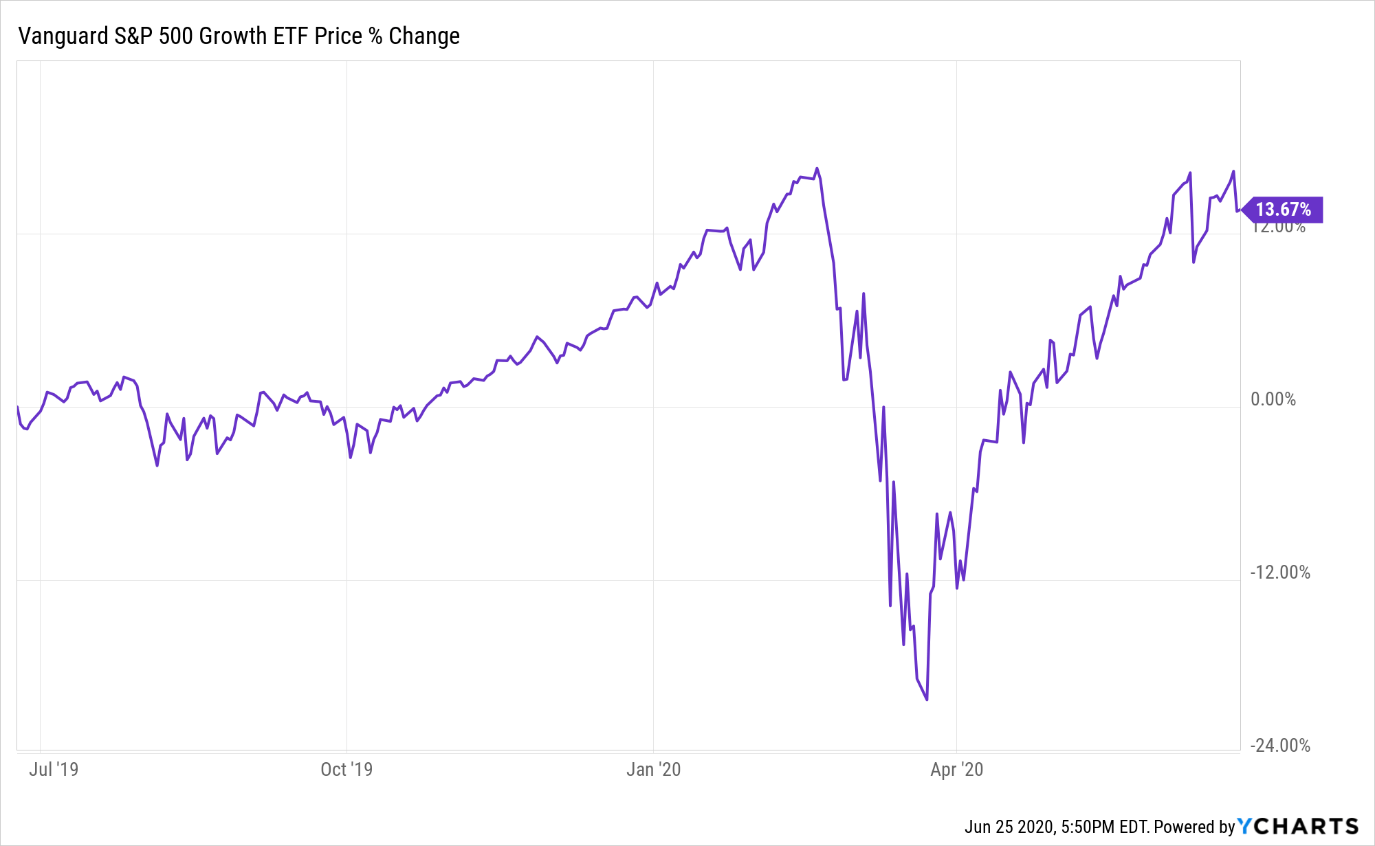

Get the latest Vanguard S&P ETF (VOO) real-time quote, historical performance, charts, and other financial information to help you make more informed. Vanguard S&P Index ETF. TSX:VFVCanada · Bid / Lots. / 15 · Ask / Lots. / 1 · Open / Previous Close. / · Day Range. Low Browse a list of Vanguard's ETFs, including performance details for both index and active ETFs. How to buy VOO ETF on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in VOO ETF. Complete Vanguard S&P ETF funds overview by Barron's. View the VOO funds market news. Vanguard S&P ETF. . . 1D. 1W. 1M. 3M. YTD. 1Y. 5Y. ALL. Why Robinhood? Robinhood You can buy or sell VOO and other ETFs, options, and stocks. Sign up. Find the latest Vanguard S&P ETF (VOO) stock quote, history, news and other vital information to help you with your stock trading and investing. Get Vanguard S&P ETF (VOO:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. VOO Performance - Review the performance history of the Vanguard S&P ETF to see it's current status, yearly returns, and dividend history. Get the latest Vanguard S&P ETF (VOO) real-time quote, historical performance, charts, and other financial information to help you make more informed. Vanguard S&P Index ETF. TSX:VFVCanada · Bid / Lots. / 15 · Ask / Lots. / 1 · Open / Previous Close. / · Day Range. Low Browse a list of Vanguard's ETFs, including performance details for both index and active ETFs. How to buy VOO ETF on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in VOO ETF. Complete Vanguard S&P ETF funds overview by Barron's. View the VOO funds market news. Vanguard S&P ETF. . . 1D. 1W. 1M. 3M. YTD. 1Y. 5Y. ALL. Why Robinhood? Robinhood You can buy or sell VOO and other ETFs, options, and stocks. Sign up. Find the latest Vanguard S&P ETF (VOO) stock quote, history, news and other vital information to help you with your stock trading and investing. Get Vanguard S&P ETF (VOO:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. VOO Performance - Review the performance history of the Vanguard S&P ETF to see it's current status, yearly returns, and dividend history.

Schwab S&P Index Fund; Shelton NASDAQ Index Direct; Invesco QQQ Trust ETF; Vanguard Russell ETF; Vanguard Total Stock Market ETF; SPDR Dow Jones. Find the latest quotes for Vanguard S&P ETF (VOO) as well as ETF details, charts and news at kupibest24.ru Vanguard S&P ETF. . . 1D. 1W. 1M. 3M. YTD. 1Y. 5Y. ALL. Why Robinhood? Robinhood You can buy or sell VOO and other ETFs, options, and stocks. Sign up. " Vanguard S&P ETF seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. ". The Fund seeks to track the performance of its benchmark index, the S&P The Fund employs an indexing investment approach. The Fund attempts to replicate. One can easily invest in S&P Vanguard ETF shares from India by: Direct Investment - Opening an international trading account with Groww which includes KYC. Key statistics for Vanguard S&P UCITS ETF (IE00B3XXRP09) plus portfolio overview, latest price and performance data, expert insights and more. Vanguard S&P Growth ETF (VOOG) - Find objective, share price, performance, expense ratio, holding, and risk details. Get the live Vanguard S&P ETF (VOO) ETF stock quote, historical prices, returns, largest holdings, expense ratio, and more on Vested. Vanguard S&P funds offer well-diversified, market-cap-weighted portfolios of of the largest US stocks. Tracks the value companies of the S&P Index as identified by three factors: book/price ratio, earnings/price ratio, and sales/price ratio. Product summary · Invests in stocks in the S&P MidCap Index, representing medium-size U.S. companies. · Focuses on closely tracking the index's return. A fee that's deducted from your account to cover the cost of maintaining the account. At Vanguard, these annual fees range from $15 to $25 depending on the type. Learn everything about Vanguard S&P ETF (VOO). News, analyses, holdings, benchmarks, and quotes. Is Vanguard S&P UCITS ETF (USD) Accumulating paying dividends? Vanguard S&P UCITS ETF (USD) Accumulating is an accumulating ETF. This means that. Current and Historical Performance Performance for Vanguard S&P ETF on Yahoo Finance. S&P Small-Cap Index Fund seeks to track the performance of a benchmark index that measures the investment return of small-capitalization stocks. Get detailed information about the Vanguard S&P ETF. View the current VOO stock price chart, historical data, premarket price, dividend returns and. This prospectus describes Vanguard S&P ETF, a class of shares issued by Vanguard Index Fund. In addition to ETF. Shares, the Fund offers three. S&P Value Index Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization value stocks.